Additional principal payment on mortgage calculator

Your monthly mortgage payment will consist of your mortgage principal and interest. If you make a down payment of less than 20 with a conventional mortgage youll need to pay an additional payment for private mortgage insurance.

Mortgage Payoff Calculator With Line Of Credit

American Financing is not a licensed financial advisor.

. This protects the lender in case a borrower defaults on a mortgage. Factors in Your California Mortgage Payment. You can calculate a monthly mortgage payment by hand but its easier to use an online calculator.

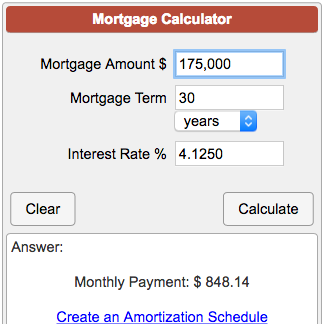

The variables are defined below. This calculator will help you to determine the principal and interest breakdown on any given payment number. M monthly mortgage payment.

This is the best option if you are in a rush andor only plan on using the calculator today. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI. P the principal amount.

Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. If you pay additional principal each month your loan or mortgage will be paid earlier than scheduled and you will pay less in interest charges. It will figure your interest savings and payoff period for a variety of payment scenarios.

30-Year Fixed Mortgage Principal Loan Amount. Use this PITI calculator to calculate your estimated mortgage payment. This calculator doesnt include mortgage insurance or.

Additional One-Time Payments. Each month a payment is made from buyer to lender. Usually 15 or 30 years in the US.

Not every homeowner will benefit from making an additional mortgage principal payment here and there. The following example shows how much time and money you can save when you make a 13 th mortgage payment every year starting from the first year of your loan. The basic industry formula for calculating mortgage payment is as follows.

Choose a term and interest rate that best suits your needs and your timeline. You can make biweekly payments instead of monthly payments and you can make additional principal payments to see how that also accelerates your payoff. PITI is an acronym that stands for principal interest taxes and insuranceAfter inputting the cost of your annual property.

Term and Interest rate. Youll need to know your principal mortgage amount annual or monthly interest rate and loan term. Enter the loans original terms principal interest rate number of payments and monthly payment amount and well show how much of your current payment is applied to principal and interest.

A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. This is the purchase price minus your down payment. It calculates your monthly payment and lets you include additional extra payment prepayments to see how soon you could pay off your home or how much you could save by paying less interest.

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. Property taxes in California are a relative bargain compared to the rest of the nation. The calculator allows you to enter a monthly annual bi-weekly or one-time amount for additional principal prepaymentTo do so click.

The mortgage amount rate type fixed or variable term amortization period and payment frequency. Actual payment could include other amounts such as escrow for insurance and property taxes private mortgage insurance PMI fees and dues. You can also use the calculator on top to estimate extra payments you make once a year.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of.

Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided. So if youre currently paying 1000 per month in principal and interest payments youd have to pay roughly 1500 per month to cut your loan term in half. How to estimate mortgage payments.

The information contained in this article is not nor. An additional cost of taking out a mortgage if your down payment is less than 20 of the home purchase price. For example if youre interested in paying off your mortgage off in 15 years as opposed to 30 you generally need a monthly payment that is 15X your typical mortgage payment.

The monthly payment and interest are calculated as if the mortgage or loan were being paid over this length. Mortgage payment calculator formula. The additional amount you will pay each month over the required Monthly Payment amount to pay down the principal on your loan.

Amount of the principal loan balance the interest rate the home loan term and the month and year the loan begins. Mortgage Calculator zip file - download the zip file extract it and install it on your computer. The mortgage payment estimate youll get from this calculator includes principal and interest.

M P i1 in 1 in 1. Fixed Monthly Payment Amount This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. The Vertex42 Mortgage Payment Calculator is a very simple spreadsheet that lets you compare different mortgages side-by-side.

Also choose whether Length of Amortized Interest is years or months. This is the best option if you plan on using the calculator many times over the. If you choose well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

I monthly interest rate. A portion of the monthly payment is called the principal which is. This Bi-Weekly Mortgage Calculator makes the math easy.

Before doing anything else use the above extra mortgage payment calculator and see how much you may save in the long run. Certain other loans like FHA or USDA loans also require a similar monthly payment mortgage insurance premium or MIP regardless of the size of your down payment. For additional information about or to do calculations involving mortgages or auto loans please visit the Mortgage Calculator or Auto Loan Calculator.

On top of that bill youll have to consider property taxes and homeowners insurance as two more recurring expenses. Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. The TD Mortgage Payment Calculator uses some key variables to help estimate your mortgage payments.

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Downloadable Free Mortgage Calculator Tool

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Interest Payment Calculator Sale Online 57 Off Www Ingeniovirtual Com

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Free Interest Only Loan Calculator For Excel

Early Mortgage Payoff Calculator Be Debt Free Mls Mortgage

Mortgage With Extra Payments Calculator

Downloadable Free Mortgage Calculator Tool

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Money Management Advice

Extra Payment Mortgage Calculator For Excel

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments